Thoughts | AI and Finance: Will AI reshape the Role of a Bank Advisor?

It seems every single day there’s some sort of news regarding advances in artificial intelligence (AI). And yet, as we are being wow’d, experts remind us that this is just the beginning.

In this newsletter, we will do a short dive into banking (finance) and how AI could change the role of a bank advisor.

The banking sector, known for its resilience and adaptability, is on the brink of another transformation, with AI leading the charge. As bank advisors, professionals who have long been the backbone of personal and corporate banking services, it’s crucial to reflect on how AI might influence the many roles and the broader banking landscape.

Firstly, let’s look at the economic impact.

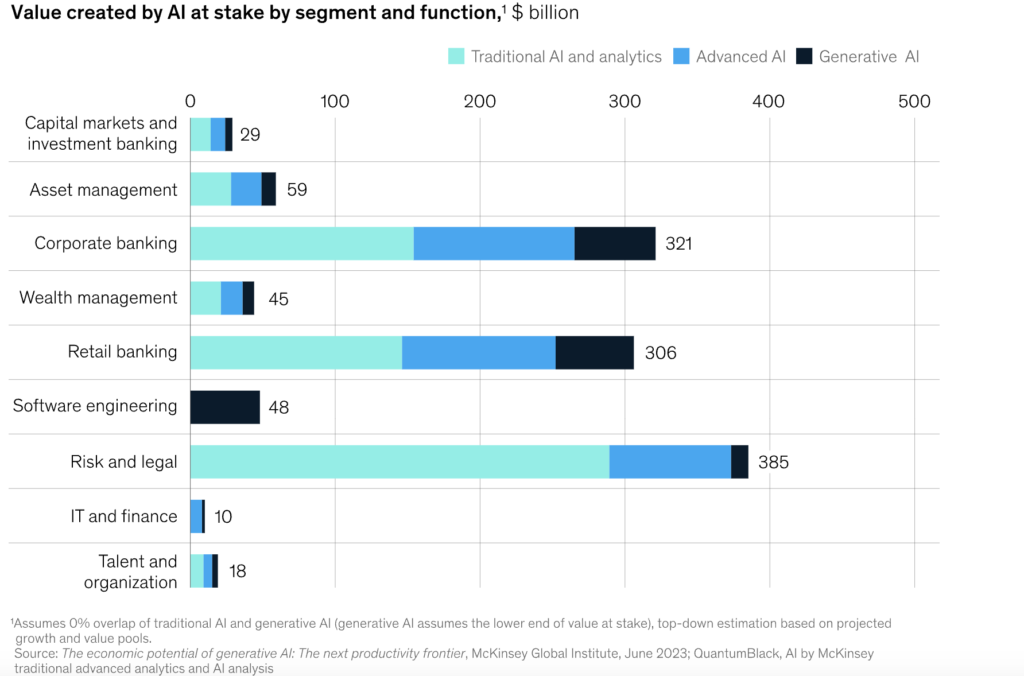

Generative AI has the potential to deliver significant new value to banks – between $200bn and $340bn

The McKinsey article on generative AI in banking highlights its profound economic and productivity impacts on the industry. Generative AI, characterised by its ability to create and synthesise new content, offers a transformative potential for banks, estimated to contribute an annual value between $200 billion to $340 billion. This significant impact stems from various applications across customer service enhancement, agent productivity, and software development.

So in practise, what could this look like? (2:09)

Let’s delve into some probing questions, this time with a focus on the everyday job of a bank advisor (with some help of a job description from a live job).

1. Which aspects of a bank advisor’s job could be automated?

Consider the routine tasks an advisor undertakes daily—calculating loan eligibility, assessing risk profiles, or even answering basic customer queries. AI has the potential to automate these processes, streamlining operations and freeing up advisors to focus on more complex, value-added activities. How might this shift affect the approach to client interactions and service?

2. How can AI augment a bank advisor’s performance?

AI isn’t just about replacing human effort; it’s about enhancing it. For bank advisors, AI tools could offer deeper insights into customer behaviour, predictive analytics for financial trends, or personalised investment advice. Imagine having the capability to provide tailored financial solutions with the support of AI-driven data analysis. In what ways could AI elevate an advisory role to offer more strategic, personalised advice?

3. What new roles might emerge in the banking industry due to AI?

As AI redefines traditional banking services, new roles are likely to surface. These could involve managing AI systems, ensuring the ethical use of AI in financial decision-making, or specialising in human-AI collaboration for personalised banking solutions. Reflect on the opportunities these emerging roles could present for career growth within the banking sector.

4. How can bank advisors adapt and upskill for an AI-driven future?

The integration of AI into banking necessitates a shift in skill sets for bank advisors. Beyond financial expertise, consider acquiring knowledge in AI and data analytics, honing your emotional intelligence for deeper client relationships, or developing skills in ethical decision-making and AI oversight. What steps can you take to align your expertise with the evolving demands of an AI-enhanced banking environment? (Cheeky plug! We have an AI Work and Skills Academy 🤯)

5. Are there ethical considerations in how AI is applied in banking?

The deployment of AI in banking raises important ethical questions, particularly around data privacy, bias in AI algorithms, and the impact on employment. As a bank advisor, engaging with these issues is critical to ensure that AI technologies are implemented in a way that respects client trust and promotes financial inclusion. How can you contribute to the ethical discourse surrounding AI in your field?

By exploring these questions, bank advisors can gain a clearer understanding of how AI might reshape their roles and the banking industry at large. The emergence of AI presents an opportunity not just for operational efficiency but for reimagining the essence of personal banking. Embracing this change requires a proactive approach to learning, ethical engagement, and a commitment to enhancing the human touch in financial advisory services.

The successful implementation of generative AI in banking hinges on effectively scaling and integrating these technologies into existing systems. This requires not only traditional change management skills but also a nuanced understanding of AI’s unique challenges and potentials. The article underscores the urgency for banks to adopt and adapt to generative AI technologies, emphasising their critical role in reshaping business models and operational processes in the banking sector. This adoption is not just about staying ahead in technology; it’s about redefining the competitive landscape and setting new standards in efficiency, customer engagement, and innovation in the banking industry.

Given what we have explored, remember that the ultimate goal is to leverage AI in ways that enrich client relationships and foster a more inclusive, informed financial landscape. Let’s seize this moment to redefine the role of a bank advisor in an AI-driven world, ensuring that we remain indispensable partners in our clients’ financial journeys.

Next week, we’re going to explore the AI companies shaping the future of work (outside of AI Work and Skills 😜). Stay tuned!

By Isa Mutlib FIEP, Assoc CIPD

Want to share some thoughts? Let’s chat. Email me on isa@careers.camp

This blog is part of our AI Work and Skills newsletter on LinkedIn, where we explore the impact of AI on work, skills, and beyond. Stay tuned for more insights and discussions from leading voices in the field.

The AI Work and Skill Forum brings together key stakeholders to discuss the impact of AI on the future of work and skills. Come join us on May 21st 2024 in London for the next Forum event. https://aiworkandskills.com

The AI Work and Skills Academy trains teams with AI literacy and data skills through short courses and apprenticeships to build AI empowered workforces. https://academy.aiworkandskills.com